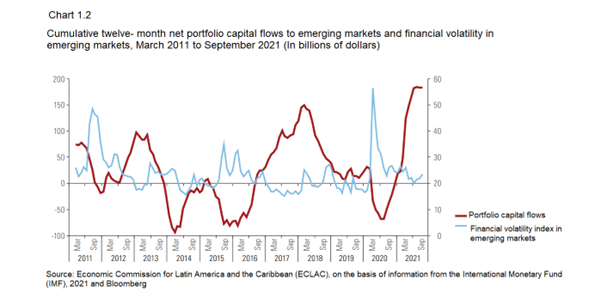

Despite volatility related to not only the effects of pandemic, but also to expectations about the outlook for inflation and the possibility of anticipated withdrawals from monetary stimulus, international financial markets performed well in 2021. This increased the likelihood that central banks in developing economies would reduce their monetary stimulus, which would have a negative impact on Latin America’s emerging markets.

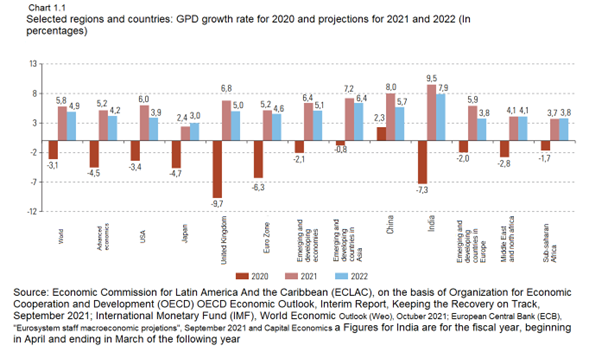

The global economic growth forecast for 2021 is 5.8 percent, owing to a deficit in service balance, which was primarily influenced by a shortfall in transportation and other services, raising the value of imports. On the other hand, the deficit in rent balance increased in 2021, initially due to the greater use of utilities by foreign investors, in the context of rising commodity prices. As a result, the current account deficit in rent balance in 2021 was -0.6 percent of the PIB. Given the oscillation, a 4.9 percent average is expected this year due to logistical issues with the region’s two major commercial partners, the United States and China, due to high shipping costs and delays.

Economic challenges abound in Latin America

The most optimistic forecast for growth in the Latin American region is from one of the most affected economic sectors by pandemic (construction, commerce, manufacturing, transportation, and communications), which will show a generalized increase in the second quarter of 2021, but not at the expense of the other sectors, which will also show a significant increase between 2020 and the first quarter of 2021, as formal employment in these sectors increased.

It is predicted that by 2022, developed economies will be the only ones to experience a greater or equal economic growth than the rest of the world, but with the growth demonstrated by Latin American startups in the last two years, this could change.

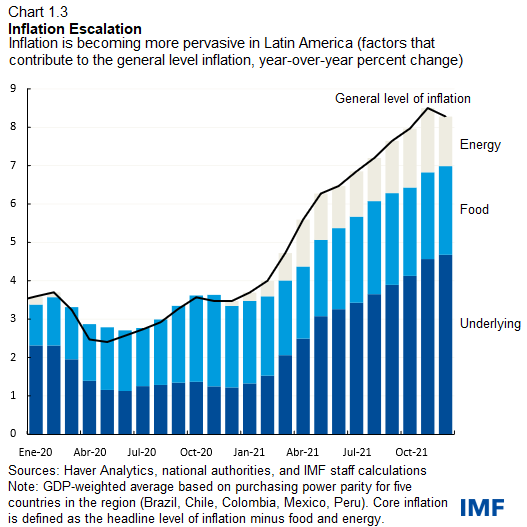

It should be noted that one factor influencing the region’s monetary policy dynamics has been a general decline in inflation since the second quarter of 2020, with the highest level recorded in South American countries, where 7.0 percent was recorded in September 2021, representing a 3.9 percentage point increase over December 2020. As determinados global factors in terms of supply and demand demonstrate the regional impact of inflation, suspensions in logistical networks, and high depreciations in regional currencies have all had an impact on regional inflation dynamics.

Monetary Policy

In 2022, it is planned to maintain a fiscal policy in favor of Latin America’s economic growth, which encourages investment and collaboration in macroeconomic issues, thereby accelerating the recovery of economic sectors and laying the groundwork for long-term growth; however, increases in interest rates and difficulties in capital markets may persist as a minimum until the middle of 2022.

In terms of net capital flows to emerging markets, they are favored by the low volatility environment and have maintained the upward trend that began in the middle of 2020 and has remained stable throughout 2021.

This does not imply a reduction in the monetary authority’s balance sheet, but rather a slower rate of monthly growth.

The fight against inflation will have to be combined with structural policies that promote growth, because Latin American economies are losing momentum despite having had a lot of help from strong commercial growth, the level of raw material prices, and appropriate external financing conditions.

In terms of 2022, the growth rate is expected to be 2.4 percent, down from 3 percent in October of 2021.

Increase in prices

The year 2021 was marked by rising inflation in Latin America’s largest economies, with prices rising by 8.3 percent, one of the highest rates in the last 15 years.

This is evident due to the rise in food and energy prices. In terms of subyacent inflation, which discriminates against these prices, there was a 6.3 percent increase, which was swift and indicates that it was more widespread than previous pandemia trends, which were 5.3 percent on average in other emerging markets.

Despite price increases and other factors, we can say that the Latin American market is one of the strongest and fastest growing in the world. However, the strength of emerging markets allows us to provide favorable figures in the region. Furthermore, startups in the region are demonstrating a progressive increase, which benefits the region’s economy by lowering unemployment rates and increasing the PIB.

More information about Latin America and various startups can be found on our blogs